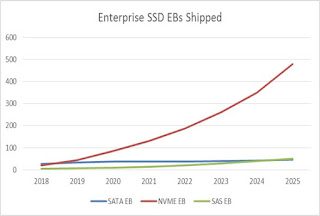

At the NVMe Developer Days Conference last week, there were multiple presentations on applications, reference designs, NVMe over Fabric solutions and examples. At the end, I presented unit and EB growth numbers for 2018 through 2025 for NVMe Devices.

Takeaway:

- NVMe Client SSD Capacity will grow at 48% CAGR through 2025 (growth declines over time with saturation)

- NVMe Enterprise/Datacenter Capacity will grow at 57% CAGR through 2025 (No saturation)

These numbers are based on attach rates, EB growth, shift from SATA/SAS to NVMe over time.

- What is needed to support this growth?: multiple solutions from multiple vendors at multiple segment levels for NVMe. This will bring price drops needed. This has already started in 2018 and is expected to continue

- What is limiting this?: Enterprise storage is a slow, conservative business. 15K HDDs continue to sell by the millions despite being an inferior solution to SSDs in performance applications.

Call for more information on how NVMe is transforming the future of storage

Mark Webb